Among the six major pharmaceutical segments in the A-share market, traditional Chinese medicine and pharmaceutical business (pharmaceutical circulation) have been at the lowest valuations for many years. According to wind data, the valuation of each sub-sector of medicine (PETTM) are: medical services (112.12 times), biological products (61.68 times), chemical pharmaceuticals (44.3 times), raw materials (40.23 times), and traditional Chinese medicine (33.08 times) , Pharmaceutical business (20.16 times). At present, A-share Chinese medicine companies have all disclosed their 2020 performance and the first quarterly report of 2021. By interpreting key companies, we can observe two different business models that are representative of the traditional Chinese medicine industry: "active transformation" and "rooted in the original industry, insisting on non-transformation".

1. The revenue of 8 companies exceeded 10 billion, and the R&D investment of 23 companies exceeded 100 million.

On the whole, in 2020, 63 A-share Chinese medicine companies will achieve a total revenue of 304.54 billion yuan and a net profit of 29.01 billion yuan. Among them, 22 achieved positive growth in total revenue (the highest growth rate reached 50.8%, and the lowest growth rate fell 36% year-on-year), and 42 achieved positive net profit growth (the highest growth rate reached 672%, and the lowest growth rate fell 85.7% year-on-year. ).

In terms of breakdown, in 2020, there will be 8 Chinese medicine companies with total revenue exceeding 10 billion yuan. From high to low, they are Baiyunshan, Yunnan Baiyao, Buchang Pharmaceutical, Wanbang, China Resources Sanjiu, Tasly, Tongrentang and Taiji Group; total The highest revenue growth rates are Ling Pharmaceutical (+50.8%) and Hongri Pharmaceutical (29.7%), while Shanghai Kaibao (-36%) and Kangyuan Pharmaceutical (-33.6%) total revenue growth The lowest. At the same time, last year there were nine Chinese medicine companies whose net profit exceeded 1 billion. Yabao Pharmaceutical (672%), Zuoli Pharmaceutical (247%) and Conba (231.2%) have the highest net profit growth, and 9 companies have doubled their growth. On the contrary, Longshen Rongfa, Dali Pharmaceutical, Guangyuyuan and Teyi Pharmaceutical's net profit growth rate fell by more than 74% year-on-year.

The performance of Yunnan Baiyao, Tongrentang, Pien Tze Huang, and Dong E E Jiao, which are known as the "Four Major Brands of Traditional Chinese Medicine", will differ in their performance in 2020:

Yunnan Baiyao achieved total revenue of 32.743 billion yuan, an increase of 10.4% year-on-year, and a net profit of 5.516 billion yuan, a year-on-year increase of 31.8%. 2021Q1 achieved total revenue of 10.328 billion yuan (+33.38%) and net profit of 763 million yuan (-40.48%);

Pien Tze Huang achieved total revenue of 6.511 billion yuan, a year-on-year increase of 13.8%, and net profit of 1.672 billion yuan, a year-on-year increase of 21.6%. 2021Q1 achieved total revenue of 2.02 billion yuan (+16.76%) and net profit of 565 million yuan (+20.84%);

Donge Ejiao achieved total revenue of 3.409 billion yuan, a year-on-year increase of 14.8%, and net profit of 43 million yuan, a year-on-year increase of 109.5%. 2021Q1 achieved total revenue of 733 million yuan (+67.56%) and net profit of 62 million yuan (+173.51%);

Tongrentang achieved total revenue of 12.826 billion yuan, down 3.4% year-on-year, and net profit of 1.031 billion yuan, an increase of 4.7% year-on-year. In 2021Q1, it achieved total revenue of 3.706 billion yuan (+22.33%) and net profit of 318 million yuan (+33.24%).

Among them, the reason for the decline in Tongrentang's performance last year was mainly due to the impact of the new crown epidemic. The company's subsidiary Tongrentang Sinopharm is located in Hong Kong, China, and has operations in many countries and regions around the world. Repeated epidemics at home and abroad and continuous prevention and control measures have caused serious problems in its daily operations. Great impact; at the same time, the speed of opening stores last year has slowed down compared with the previous year. In addition, Yunnan Baiyao's investment loss in the first quarter of this year was 789 million yuan, resulting in a sharp drop in net profit attributable to its parent.

From the perspective of R&D investment, there will be 23 Chinese medicine companies with R&D expenses exceeding 100 million yuan in 2020. Among them, the research and development expenses of Yiling Pharmaceutical, Buchang Pharmaceutical, Baiyunshan, Tasly and China Resources Sanjiu all exceeded 580 million yuan.

2. Actively transforming Chinese medicine companies

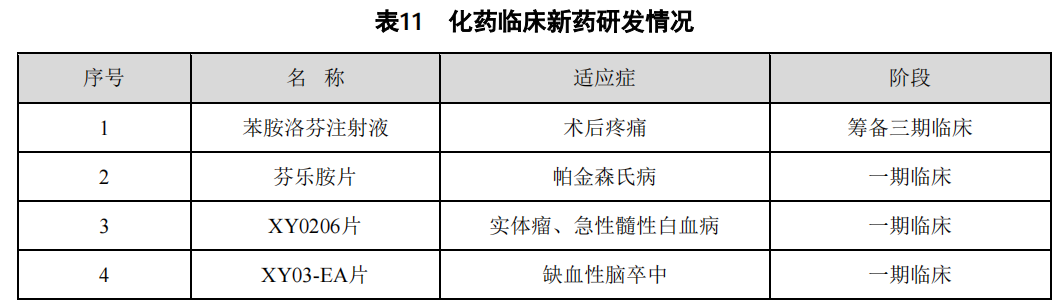

Judging from the performance in 2020 and the operating situation in the first quarter of this year, Chinese medicine companies as a whole can be divided into two types: "active transformation" and "rooted in the original industry, insisting on not transforming". Either based on the general trend of the Chinese medicine industry's in-depth development towards greater health, or following the case of Yunnan Baiyao’s successful transformation from traditional Chinese medicine business to daily chemical products, in recent years Yiling Pharmaceutical, Renhe Pharmaceutical, Pien Tze Huang, Buchang Pharmaceutical, Tasly Etc. has been actively transforming and expanding product lines. On the whole, the direction of transformation of Chinese medicine companies is in addition to the big health business, but also expands to various fields such as biological medicine (antibody drugs, recombinant proteins, therapeutic vaccines) and innovative chemical drugs. For example, Yiling Pharmaceutical, which ranks first in R&D expenditure in the Chinese medicine industry in 2020, is actively deploying chemical and biological medicine and health industries while developing innovative Chinese medicine research and development. As of 2020, Yiling Pharmaceutical has 11 patented new drugs, covering the fields of cardiovascular and cerebrovascular diseases, respiratory, diabetes, tumors, nerves, urinary and other clinically frequently-occurring and major diseases (high morbidity, large market use of drugs). Form a relatively rich product group. In the chemical and biopharmaceutical sector, Yiling Pharmaceutical has formulated a development strategy of "transfer and processing cut-in-international and domestic double registration of generic drugs-patented new drug R&D, production and sales". In terms of generic drug business, for the US market, the company has 12 ANDA products approved by the US FDA, and some of the products have been sold to the US; for the Chinese market, the company has currently 4 products passed the consistency evaluation, and 4 others The product has entered the priority review procedure of the Drug Evaluation Center of the State Drug Administration. In terms of innovative drug business, Yiling Pharmaceuticals currently has 4 first-class innovative drugs that have entered the clinical stage, and many first-class innovative drugs are in the preclinical research stage. Among them, aniprofen injection has ended the second clinical phase and is in preparation. Phase III clinical.

In addition, Renhe Pharmaceuticals, which once owned well-known brands such as Renhe Klick, Yocardan, Fuyanjie, and Shining Eye Drops, is also a typical representative of active transformation. In 2015, in order to transform the field of pharmaceutical e-commerce, Renhe Pharmaceutical acquired 60% of Jingwei Yuanhua (later renamed Renhe Pharmacy.com) for 326 million yuan to deploy online pharmacies. But in the following years, due to poor performance, it was finally forced to sell Renhe Pharmacy at a discount. In 2019, the company announced the layout of the industrial hemp business. Today, Renhe Pharmaceuticals, which has undergone many failed transformations, still has not set foot in the research and development of innovative drugs. At present, the company has 3 generic drugs that have passed consistency evaluation, including amlodipine besylate tablets, gliclazide sustained-release tablets and folic acid tablets, as well as 7 chemical drugs in 4 categories, but most of them are in preclinical pharmacy. In the research phase, the rest are all Chinese medicines that are in the material benchmark research phase, and the road of transformation has not yet seen significant results. In addition, there are many Chinese medicine companies that are actively transforming. For example, since 2014, the establishment of the "one core and two wings" strategy for healthy development (on the basis of consolidating the pharmaceutical manufacturing industry, strengthening the two wings of cosmetics, daily chemical products and health products, and health food, and at the same time expanding the pharmaceutical circulation industry as a supplement) Pien Tze Huang, the daily necessities and cosmetics business growth is quite stable; Buchang Pharmaceutical, Tasly, Kangyuan Pharmaceutical, etc. in recent years have also been transformed into chemical medicine, biological medicine and other fields, and R&D investment in 2020 will also be in the forefront of the industry.

3. Chinese medicine companies that take root in the original industry and do not transform

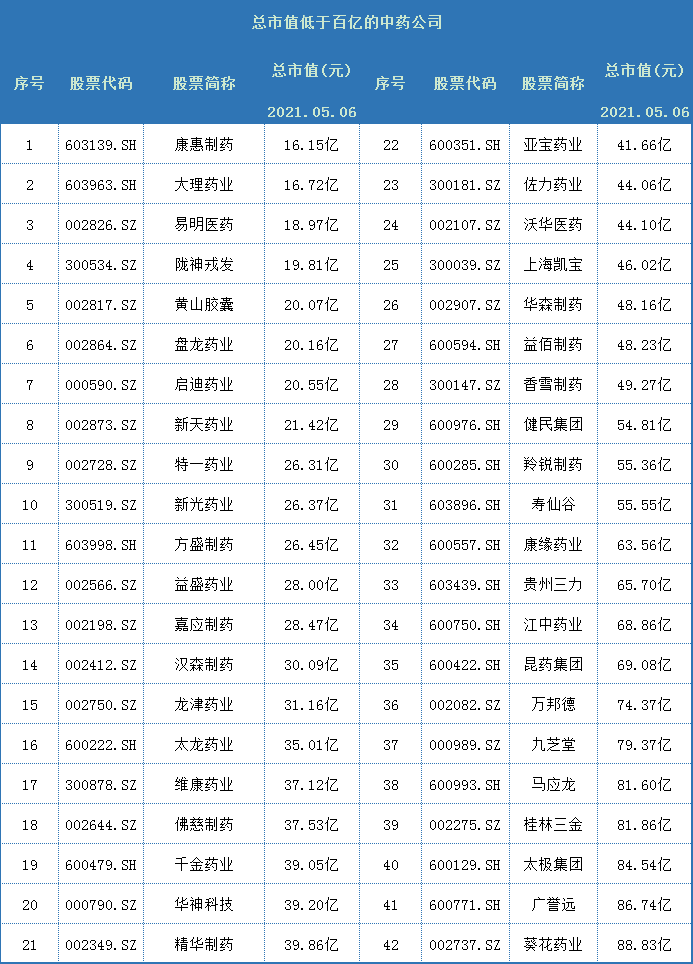

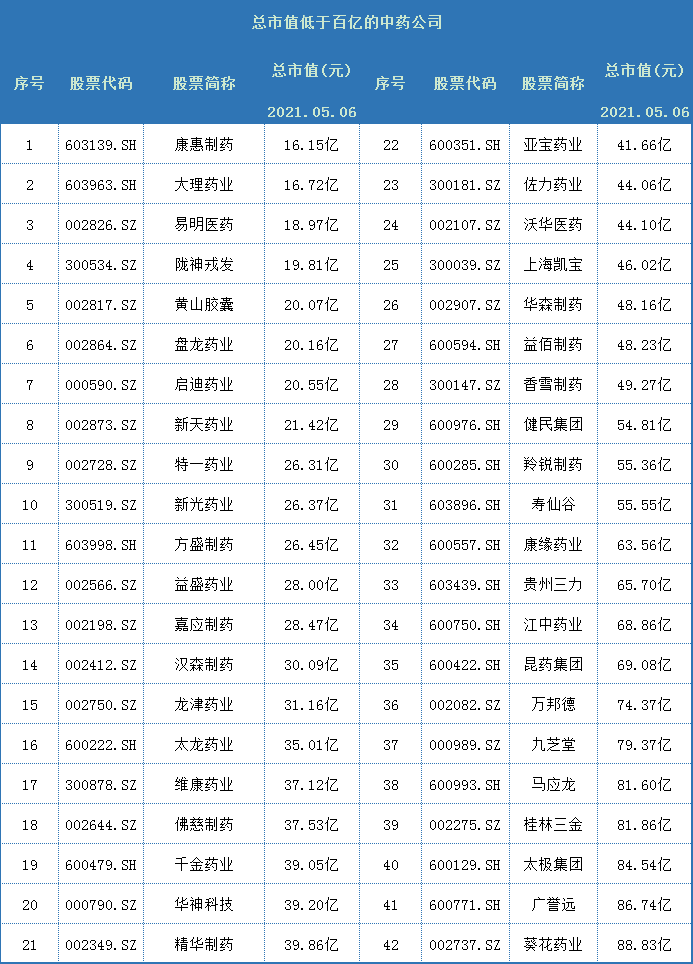

Compared with TCM companies that are actively transforming, have more room for imagination, and have higher valuation premiums, some TCM companies that insist on taking root in the original industry and neither seek transformation nor invest much in research and development, and do not merge and expand the industrial chain. The performance is not good, and the market value is still very low. As of May 6, there are still 42 Chinese medicine companies with a total market value of less than 10 billion, accounting for 66.67% of the total number of listed Chinese medicine companies. Among them, many are Chinese medicine companies that choose to take root in their original industries and not transform.

For example, Dali Pharmaceuticals, which only engages in the production and sales of Chinese and Western medicine injections, Huangshan Capsules, which focuses on medicinal hollow capsules, and Guangyuyuan, Guizhou Sanli, and Jiaying Pharmaceuticals, which focus on the research and development, production and sales of Chinese patent medicines , Kanghui Pharmaceutical, Xinguang Pharmaceutical, etc. Since its establishment, Guangyuyuan has been engaged in the business of proprietary Chinese medicines, including traditional Chinese medicines, boutique Chinese medicines and health-preserving wines. It has core products such as Guilingji, Dingkun Dan, and Angong Niuhuang Wan, but its performance has been very poor in recent years. ideal.

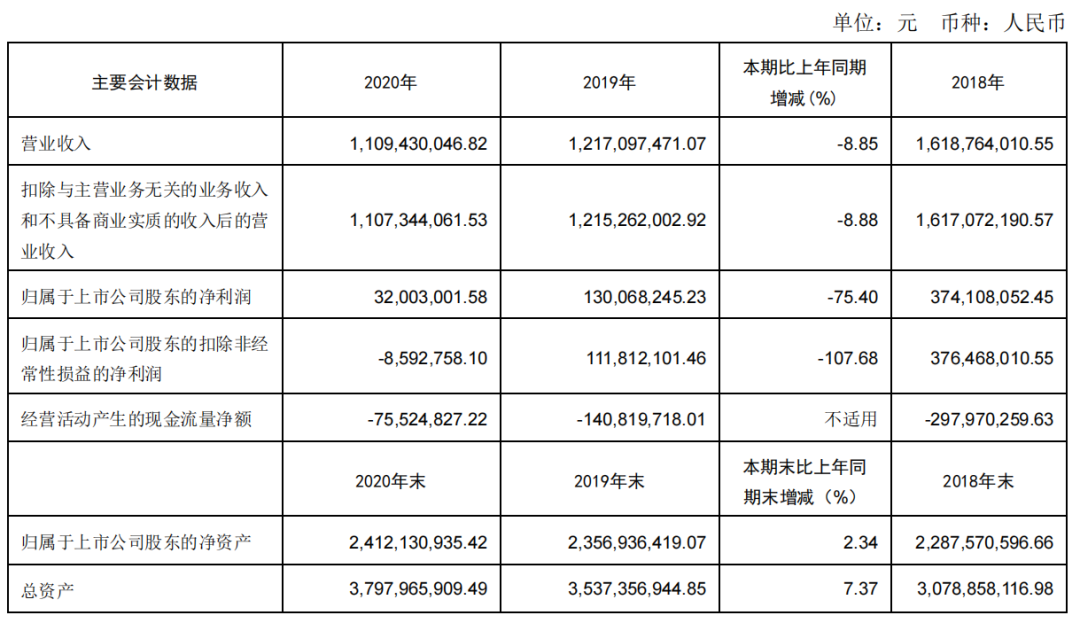

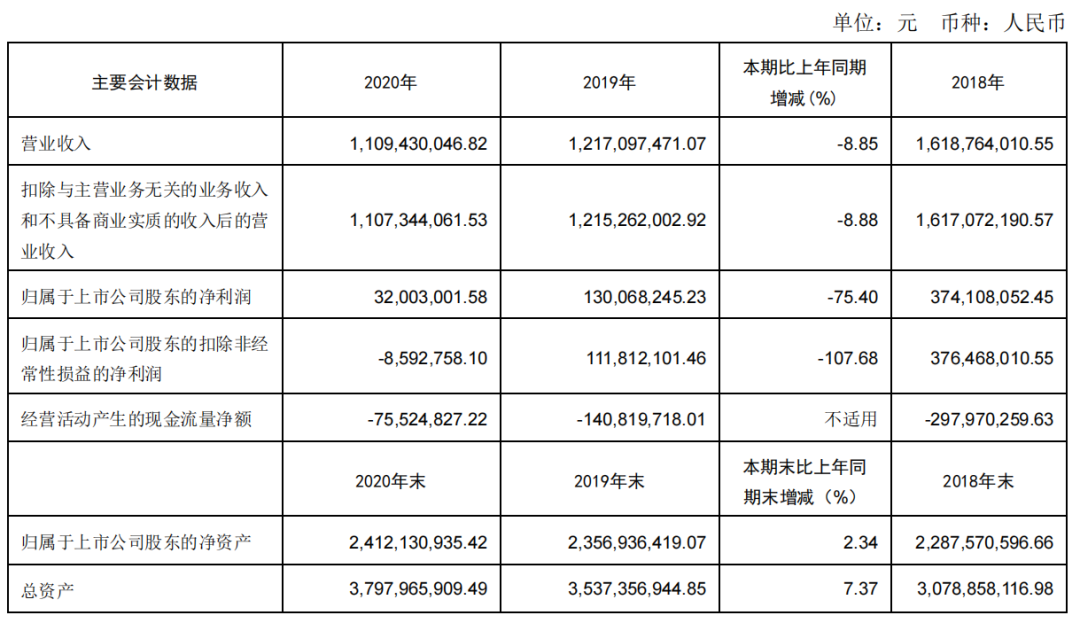

The financial report shows that from 2018 to 2020, Guangyuyuan achieved total revenue of 1.619 billion, 1.217 billion, and 1.109 billion, respectively, with year-on-year growth rates of 38.51%, -24.81%, and -8.85%; the decline in net profit was more serious, reaching 3.74 respectively. The year-on-year growth rate was 57.98%, -65.23%, and -75.40%, respectively. Among them, the net profit after deducting non-recurring gains and losses in 2020 is a loss of 8.6 million, a sharp drop of 107.68% year-on-year. The decline in the first quarter of this year continued, with total revenue of only 190 million yuan (-15.51%), net profit of 5.17 million yuan (-81.25%), and non-net profit of 1.048 million yuan (-96.30%). From 2017 to 2020, Guangyuyuan's average research and development expenses are 48.96 million yuan, and the proportion of research and development expenses in total revenue is between 2.67% and 5.15%, which is relatively low. As of the close of May 7, Guangyuyuan's total market value was 8.315 billion yuan, less than 10 billion yuan.

In addition, there are many traditional Chinese medicine companies that rely on a single product, do not transform or expand the industrial chain, and have a total market value of less than 10 billion yuan, which has become a typical and unique "landscape" of the traditional Chinese medicine industry. For example, Guizhou Sanli, which has won the world with products such as Kaihoujian spray (child type), Kaihoujian spray and strong Tianma Duzhong capsules, has an average research and development expenditure of only 4.3 million yuan in the past five years, and the current total market value is 6.346 billion yuan. ; Huangshan Capsule’s medicinal hollow capsule manufacturing business will achieve operating revenue of 319 million yuan in 2020, accounting for 99.9% of total revenue; Dali Pharmaceutical mainly focuses on the business of Chinese and Western medicine injections, and the core product is "Zhongjing®" Xingnaojing The total market value of injection and Shenmai injection is only 1.65 billion yuan.

4. Transformation or non-transformation?

In general, by combing through the 2020 financial report and the first quarter performance of 2021, it is not difficult to find the "contradictions of transformation" in the current development stage of my country's traditional Chinese medicine industry. Transformation or non-transformation has become an important issue that plagues the development of Chinese medicine companies. After sorting out the previous article, "transformation is not necessarily dead, but it must be dead if you don't transform", which may not apply to all Chinese medicine companies. Different from Western medicine companies that need to continuously develop new drugs, Chinese medicine companies pay more attention to brand inheritance or innovation in inheritance. For example, Yiling Pharmaceutical, Buchang Pharmaceutical, Tasly, etc. are all based on the concept of "inheritance and innovation" to expand the fields of chemical medicine and biological medicine. The success of the transformation depends not only on whether the business that matches the company's own advantages is correctly selected, but also on the company's management's strategic layout capabilities and resource integration capabilities.