On July 2, the Drug Evaluation Center of the National Medical Products Administration issued a notice for publicly soliciting opinions on the "Clinical Value-Oriented Anti-tumor Drug Clinical Research and Development Guidelines" (hereinafter referred to as the "Guiding Principles"). Some two requirements directly increase the difficulty for innovative drugs to pass clinical trials. One stone stirred up waves, and pharmaceutical stocks ushered in drastic adjustments in the past few days, with declines dominating the screen. The spirit of the "Guiding Principles" expounded in the draft has indeed hit the pain points of the development of China's innovative drug industry. The market has interpreted the differentiation of the industry, and "pseudo-innovation" has been interpreted as the target of severe crackdowns. We try to explore the reasons for the rise of "pseudo-innovation".

High cost: the most expensive TOP10 new drug projects

According to data from PhRMA member companies, the average cost of successfully developing a new drug in 1970 (including the cost of failed projects, the same below) was only 179 million US dollars; by 1990, the average cost of successfully developing a new drug had reached 1 billion US dollars; By 2010, the cost of successfully launching an innovative drug had reached a staggering US$2.6 billion.

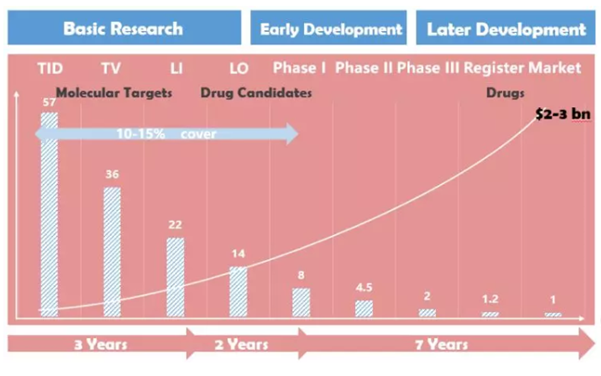

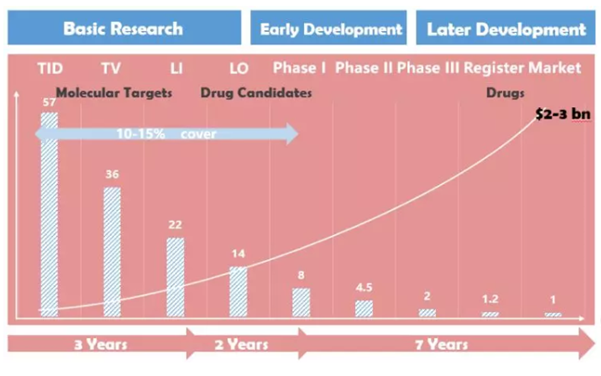

Figure 1 The development process of new drugs, the proportion of small molecule compounds entering various stages, and R&D investment.

Data source: Roche, School of Medicine, Tsinghua University, China Fortune Industry Research Institute

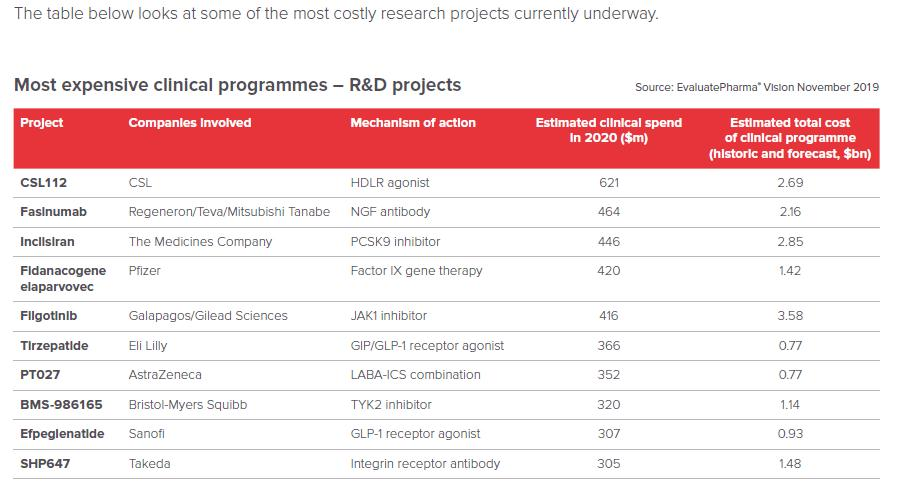

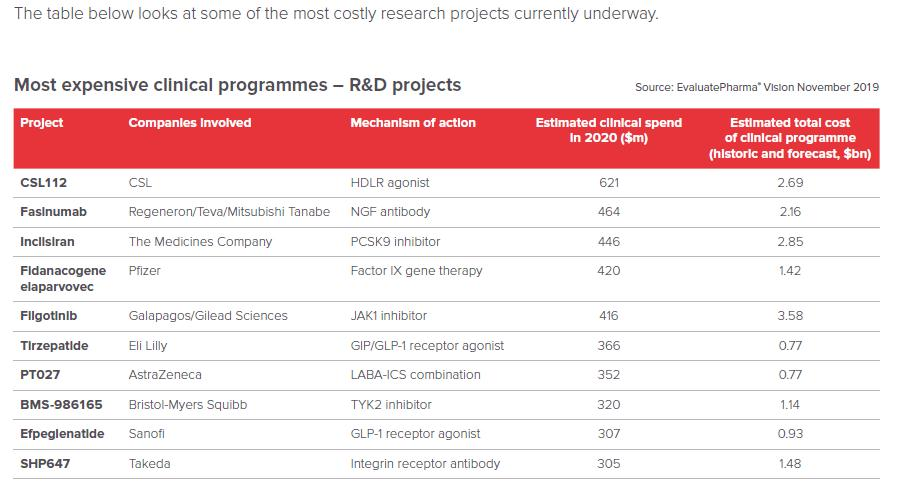

Another dimension can be seen from the clinical investment in new drug research and development to the overall investment in new drug research and development. EPVantage, a subsidiary of Evaluate, a world-renowned life science industry market consulting company, released a report predicting the top 10 new drug R&D projects in the biopharmaceutical field. The Top10 new drug research and development project predicts that the total clinical cost in 2020 will be 4.017 billion U.S. dollars. The number one apolipoprotein (Apo) A-I infusion therapy (name: CSL112) is expected to have a clinical investment of up to 621 million U.S. dollars a year. The Top10 new drug research and development project predicts that the entire clinical research and development investment will be as high as 17.790 billion US dollars. The oral JAK1 inhibitor (name: filgotinib) jointly developed by Gilead and Galapagos is expected to be 3.58 billion US dollars (approximately 23.2 billion RMB) in clinical investment, which is shocking.

Figure 2 Forecast of the most expensive TOP10 new drug R&D projects in the biopharmaceutical field in 2020

Source: EPVantage

On the one hand, the huge investment in research and development has discouraged most companies. On the other hand, even if the company is willing to invest huge funds in technological updates, its sales are still far from keeping up with the rapid growth of new drug research and development costs. With the emergence of the above-mentioned problems and the global price competition of medicines, the Me-too strategy has emerged in the research and development of new drugs. Me-too studies of H2 receptor antagonists, angiotensin converting enzyme inhibitors, proton pump inhibitors, dihydropyridine calcium antagonists, hydroxymethylglutaryl-CoA reductase inhibitors, etc. have created one after another The marketing mythology also inspires major companies to flock to it. According to the statistics of EvaluatePharma and Deloitte, the median R&D cost of domestic innovative drugs to NDA (marketing application) or approved for listing is only about 100 million yuan. In the reality of relatively insufficient investment in new drug research and development and relatively backward research levels, using the Me-too strategy to discover new drugs, compared with new drug innovation, reduces the technical difficulty, risk and R&D cost, and seems to be a good choice.

Low success rate: only 1.2% of new drugs on the market

A successful innovative drug needs to go through the following 10 steps from R&D to marketing:

Figure 3 New drug development process

The data shows that the proportion of new drug development from drug target discovery to target confirmation is 36%, the proportion of entering the lead compound screening stage is 22%, and the probability of entering the lead compound optimization screening stage is 14%; those entering clinical phase I The proportion is 8%, the probability of entering phase II clinical is 4.5%, the probability of entering phase III clinical is 2%; the probability of entering the market registration link is 1.2%. Completely innovative new drug research and development (referring to the original Firstinclass, starting from the discovery of the target), the final probability of success is only 1.2%. Some people are daunted by such a low probability of success, while others have found a breakthrough in probability analysis. The process of improving the success rate and rate of developing new drugs through innovative technologies has become increasingly difficult, and one of the fastest ways to increase the success rate is to reduce the number of new drug development steps. For example, if the target has been confirmed, then start with high-throughput screening, and even more advanced Metoo, start directly from the optimization of the lead compound, naturally, the overall success rate is increased, and the development time is shortened.

Low return on investment: only 1.8%

According to statistics from Deloitte, the world's top 12 large pharmaceutical companies (Amgen, AstraZeneca, Bristol-MyersSquibb, EliLilly, GlaxoSmithKline, Johnson&Johnson, Merck&Co., Novartis, Pfizer, Roche, Sanofi, Takeda) have an average return on investment of a new drug in 2010. Reached 10.1%. But in 2019, the figure has dropped to 1.8%, a record low.

Figure 3 Return on investment in new drug research and development

Source: Deloitte official website

Innovative research and development has been so difficult, pharmaceutical companies still hang a sword of Damox-patent cliff. Calculated based on the "Double Ten Law" of new drug research and development in the United States, it is estimated that one billion US dollars will be invested in the research and development of a new drug in 10 years. Generally speaking, the patent protection period of a new drug is 20 years, and this patent protection period starts from the new drug patent application, that is, after a new drug is listed, it may only be sold exclusively by the original research company for less than 10 years, and the research and development costs must be recovered. A new drug must have an annual profit of at least 100 million U.S. dollars for at least 10 years of patent protection. If a new drug R&D investment reaches 2.6 billion U.S. dollars, a corresponding annual profit margin of 260 million U.S. dollars will be required. According to IMSHealth's forecast, in the past ten years, the annual loss of sales revenue of branded drugs due to patent expiration will exceed 100 billion U.S. dollars.

Status: Innovative medicine blowout era

The original research companies of new drug research and development are faced with the above three problems. Correspondingly, China has entered the era of a blowout of innovative drugs. From the approval of one or two new drugs in the past year to the approval of forty or fifty new drugs a year, many new drugs are even competing for the same target. point. Under such circumstances, from R&D to sales, pharmaceutical companies are facing new value reshaping, and the original structure and business model are completely broken. How to reduce marketing expenses and improve R&D efficiency, so that products can enter the application scenarios as soon as possible and be widely covered, has become a must-answer question for the survival and development of pharmaceutical companies. From the perspective of domestic pharmaceutical innovation trends, the next 3 to 5 years will enter the post-clinical development and implementation phase, which means that pharmaceutical companies must consider the issue of commercial returns in advance from the establishment of the project. Metoo is the only choice for companies to gradually move towards innovation-driven in order to achieve stable business development. When most enterprises are aiming at this approach during the transformation period, the rise in popularity will naturally bring about the "pseudo-innovation" of the industry as a whole.

Four ways to break the game

In the past decade or so, the focus of my country's medical reform policy has been to improve the availability of medicines and control costs. Nowadays, it has shifted to increasing the speed of drug approval, expanding medical insurance access, encouraging innovation and improving quality. Accelerate the innovation and development of the entire pharmaceutical industry, and the advanced path of innovative pharmaceutical companies will begin. Facing the challenge of new drug research and development, the author suggests four ways to break the situation: 1. Exploring the value of subdivisions and formulating a clear access strategy: China has not yet established a systematic evaluation system, and products with greater challenges are expected to take the initiative in indications. After developing a clear access strategy, use it to guide the generation of value data and the organization of value materials, convey information to various stakeholders in a unified manner, and finally achieve R&D goals. 2. Big data helps value mining: Value evidence is crucial in the review and approval of new drugs, and even medical insurance access. As new drugs are launched to the shortening of the access cycle, preparing substantial value evidence will become a major challenge for new drug research and development. Companies can use big data to speed up real-world data collection, mining to support disease burden research and support cost-benefit analysis. 3. Innovative and efficient expert communication

: New drug R&D is "only fast but not broken". Enterprises can consider establishing a cross-departmental cooperative project management office (PMO), clearly assigning responsibilities, setting KPIs and timetables, and closely tracking progress and reacting swiftly. 4. Actively participate in policy advocacy and exploration: my country's new drug technology evaluation system is still in its infancy, and the mechanism for transforming technology evaluation results into industry policies is still in the exploring stage. Relevant departments are compiling relevant technical evaluation guidelines, and the formation of the system still requires continuous exploration and data accumulation. Pharmaceutical companies can actively participate in policy exploration. Driven by the market environment and policy environment, pharmaceutical companies can only develop in this environment where the strongest and the strongest can only develop their internal skills and solidly promote product innovation and upgrading.