"Magic bullet" ADC drug 10 billion gold track competition intensifies! Domestic catch-up is accelerating, 2 models have been declared for listing, Genting Xinyao, Rongchang Bio...

May 19, 2021

Recently, the domestic news on the development of ADC drug research and development has been refreshed

On May 18, the innovative ADC introduced by Xinma Biology is planned to be included in the breakthrough treatment product;

On May 17, Genting Xinyao Trodelvy (Gosartuzumab for injection)’s biological product marketing authorization application was accepted by the State Food and Drug Administration. The drug was Genting Xinyao’s Trop-2ADC drug, which was just released on May 12. Apply for listing, it is the first Trop-2ADC drug in China to apply for listing;

On May 13, the clinical trial application of Shanghai Shijian Biologics Trop2ADC was accepted by NMPA, and it was the sixth clinical Trop2ADC new drug in China;

On April 21, Fudan Zhangjiang’s Trop2-ADC drug FDA018 clinical application was accepted by NMPA...

ADC (Antibody-drugconjugates) refers to antibody-drug conjugates. It consists of three parts: monoclonal antibody, linker and cytotoxic small molecule drugs. It accurately locates tumor cells and releases high-efficiency cytotoxicity. Because ADC drugs can not only accurately identify the target, but also have no impact on non-cancer cells. Compared with other chemotherapeutic drugs, ADC drugs greatly improve the efficacy and reduce the toxic and side effects through the specific binding of antigen and antibody, which fills in the antibody drugs. The gap between traditional chemotherapeutics and chemotherapeutics has attracted the attention of people in the field of medical research and development.

Image source: Lepu Biological Prospectus

12 ADC drugs worldwide are approved for marketing, two have become over 1 billion U.S. dollars

ADC drugs have undergone three generations of technological changes. The first generation of ADC drugs is represented by Pfizer’s Mylotarg, but the antigen specificity is low, the toxic load is not strong enough, and the linker is unstable. The second generation of ADC drugs is Seattle’s Adcetris and Roche. The pharmaceutical trastuzumab (Kadcyla) is a representative, which has strong antigen specificity and is based on a random coupling strategy. It has the characteristics of heterogeneity and more stable linkers. The third-generation ADC drugs use site-specific coupling. It has homogeneous and single ADCs, and cytotoxic molecules are more effective, such as the IMGN779 and ARX788 under research. After years of development, ADC drugs have gradually entered the harvest period. According to statistics from Yaozhi data, as of now, 12 ADC drugs have been approved for the market worldwide, 7 for the treatment of hematological tumors, and 5 for the treatment of solid tumors.

Overview of ADC drugs approved for marketing worldwide

Data source: Yaozhi data

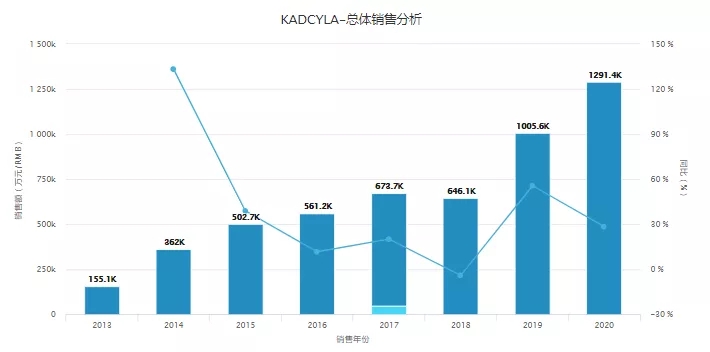

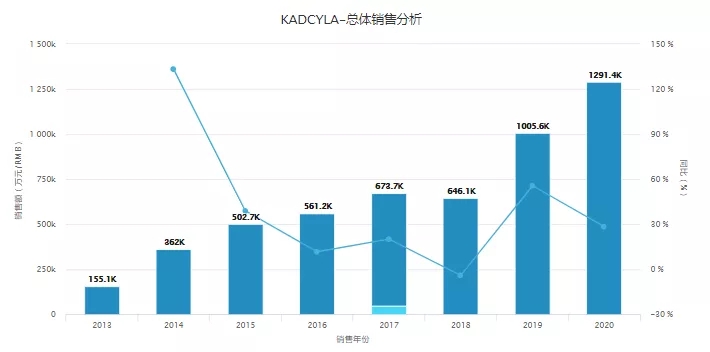

Among them, Pfizer's Mylotarg is the world's first ADC drug to be marketed. It was approved by the FDA in May 2000. However, the drug has suffered from twists and turns after it was marketed. Because of its combination of chemotherapy in post-marketing clinical studies, it failed to prolong survival and increased Because of its toxicity, the company voluntarily withdrew from the market in 2010; but Pfizer did not give up Mylotarg. After adjusting the dosage and adding more clinical data, it was again approved by the FDA for marketing in 2017, rebirth and glory. The second ADC drug to be marketed is Adcetris jointly developed by Roche Pharmaceuticals' Takeda Pharmaceuticals and Seattle Genetics. It was approved for marketing in 2011. Due to the withdrawal of Roche Pharmaceuticals Mylotarg, the approval of Adcetris not only boosted the confidence in ADC drug development, but also Overtaking in corners quickly gained the drug market in this field. In 2019, Adcetris' global sales reached 1.121 billion U.S. dollars, growing into a blockbuster with annual revenue exceeding 1 billion U.S. dollars. Roche’s Kadcyla is the world’s third ADC drug to be marketed. It was approved by the FDA in 2013 for HER2-positive metastatic breast cancer. It was approved for listing in China in early 2020, making it the first domestically approved ADC drug. ADC was born. Since its launch, Kadcyla has come from behind and rapidly expanded its market. According to Yaozhi's global best-selling drug database, its sales in 2020 will reach 12.914 billion yuan, becoming the most popular product in the ADC field and the highest annual revenue.

Image source: Yaozhi Global Best-selling Drug Database

It is predicted that the global market for ADC drugs on the market is expected to exceed 16.4 billion U.S. dollars by 2026. The huge market and research and development prospects have made the pharmaceutical industry's enthusiasm for ADC drug development unprecedentedly high, and a large number of ADC drug indications are advancing. After 2015, the number of ADC indications under research worldwide has increased rapidly, and in 2019 it reached a record high. Clinical trials of 200 ADC drug indications are underway, more and more companies are investing in ADC drug research and development, and global ADC drug research and development are in full swing. .

Trends of ADC's research indications in the past 20 years

Image source: China Sea Securities Research Report

In addition, according to Yaozhi’s global clinical trial database, according to incomplete statistics, there are 308 clinical research information on ADC drug indications so far. A large number of ADC drug research and development are in clinical phase 1-2, of which more than 30 are in clinical phase 3. In the next few years, there will be new ADC drugs on the market.

ADC drug research and development has shifted from hematoma to solid tumor metastasis.

Emerging targets have become a research and development hotspot, and many domestic researches are in progress

According to the data combing, it is not difficult to find that the preferred treatment areas of many ADC drugs in clinical research are still concentrated in non-solid tumors such as leukemia and lymphoma, and gradually transition to solid tumors such as breast cancer and ovarian cancer. And the hot spot of ADC drug research and development has shifted from hematoma to solid tumor. Correspondingly, finding suitable drug targets has become a hotspot of competition among ADC R&D companies. At present, the most important targets of ADC drugs on the market are HER2 and the CD family. TROP2 and BCMA targets will each have one drug on the market in 2020. In addition, Many new targets such as folate receptor, CA6, and conjugatein-4 are also in clinical phase II or phase III research. Among them, Trop2 is an emerging target for the potential treatment of a variety of cancers, and is expected to play a role in multiple cancers, becoming the most competitive ADC target after HER2. TROP-2 is a single transmembrane surface glycoprotein, also known as tumor-associated calcium signal transducer 2 (TACSTD2), which is related to cyclin D1 (cyclinD1) and phosphokinase C (PKC). As an important tumor development factor, Trop2 can promote tumor cell proliferation, invasion, metastasis and spread. Its high expression is closely related to the shortened survival and poor prognosis of tumor patients. Therefore, the research of anti-tumor drugs targeting Trop2 is of great significance . It is worth mentioning that in May 2020, Immunomedics (acquired by Gilead in September 2020)’s Trodelvy was launched as the world’s first TROP-2 targeted antibody-drug conjugate therapy, reaching 20.1 million in the first two months of the market. With net sales in US dollars, industry analysts previously said that the peak sales of Trodelvy after listing is expected to reach more than US$1 billion, and the ADC drug market cake is once again attractive. At the same time, the domestic research and development of ADC drugs is also very enthusiastic. According to incomplete statistics from Yaozhi data, there are currently as many as 35 new ADC drugs declared in China. Except for the two clinically terminated Biotech, there are still more than 30 models. It is in the research stage; among them, 6 companies have applied for clinical Trop2ADC new drug; in addition, CSPC, Hausen, Fuhong Henlius and other companies have also deployed Trop2. In addition, from the perspective of enterprises, many companies have multi-targeted layouts. Hengrui Medicine has 4 ADC drugs, Lepu Bio has 3 under research, and Qilu, Kelun, Rongchang, Duoxi Bio and other companies also have 2 The fastest-growing one is Rongchang Biologics' HER2 monoclonal antibody-MMAE (RC48), which is the first ADC drug to be marketed in China. In addition, the drug has also obtained fast track approval in the United States. The second is Sacituzumabgovitecan of Genting Xinyao, which is the first new drug in China to declare the Trop2ADC target for marketing. Which of the two drugs will be approved first? Can Genting Shinyao overtake a corner? Wait and see!

List of domestic ADC drug declarations

Note: The above data are all sorted manually. If there is any omission, please correct me!

Reference: Guohai Securities "In-depth report on the topic of medical and biological innovative drugs (1) ADC"