In 2025, global medical expenditures will reach US$1.6 trillion, and 20 therapeutic areas will increase at a rate of growth rate, including immunology, oncology, neurology...

May 09, 2021

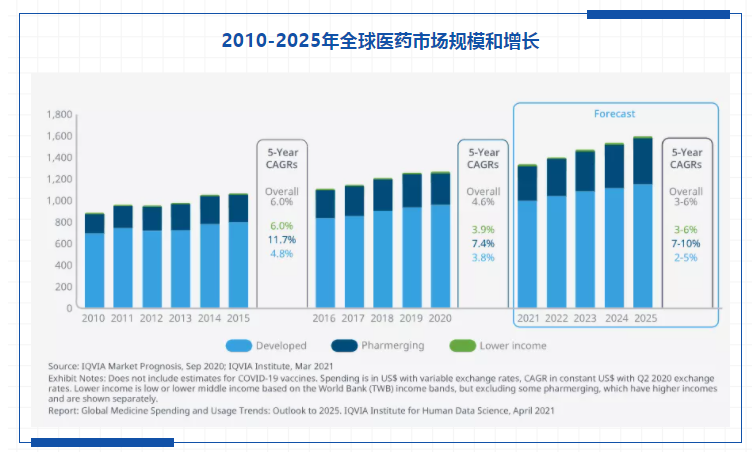

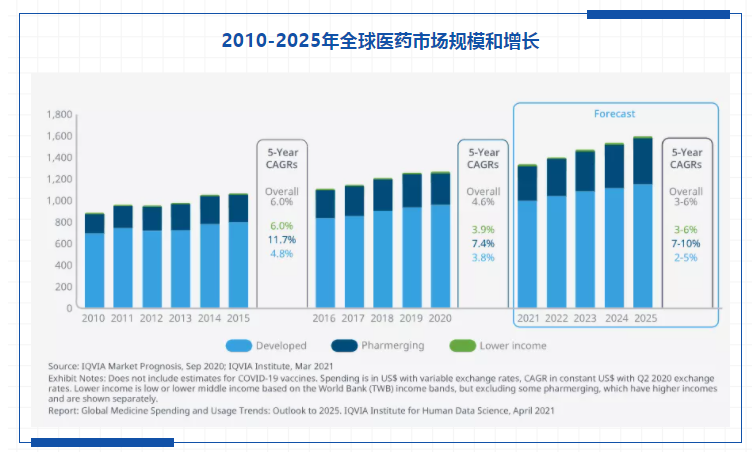

Recently, according to the latest report of the IQVIA Institute of Human Data Science, "Outlook 2025: Global Medical Expenditure and Use Trends", global pharmaceutical expenditures (using invoice price levels) will grow at a compound annual growth rate of 3% to 6%. It will reach approximately US$1.6 trillion by 2025, which does not include spending on COVID-19 vaccines.

The scale and growth of the global pharmaceutical market from 2010 to 2025

Global pharmaceutical spending slows down, and China’s innovation accelerates

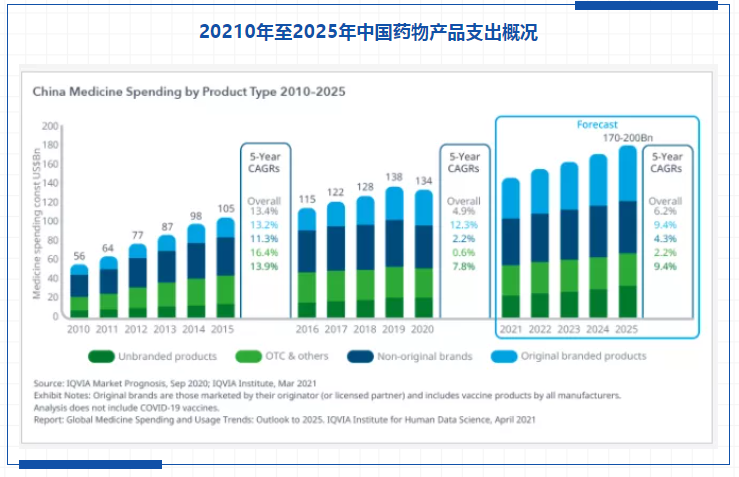

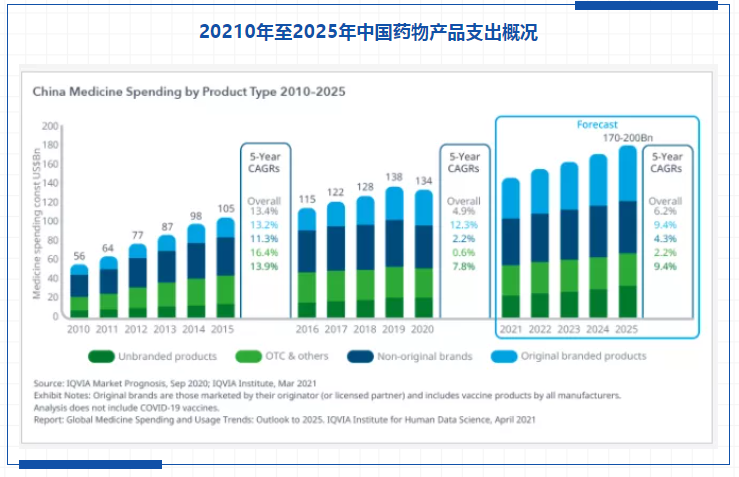

The report shows that the use and expenditure of medicines vary widely in the global market. By 2025, the strong pharmaceutical market growth will promote the growth of global pharmaceutical expenditures, but due to the expiration of large quantities of original research drug patents, the market exclusivity period causes market losses to exceed the expenditures for newly launched innovative products, which will slow the growth rate; in the future Control the global growth rate below 1% within 5 years. In addition, the report shows that by 2025, developed countries (upper-middle or high-income countries) are expected to grow at a rate of 2% to 5%, similar to the situation in the past five years. Among them, in terms of net price, the compound annual growth rate of the US market in the next 5 years is expected to be 0-3%, which is lower than the 3% compound annual growth rate of the past 5 years. It is worth mentioning that in emerging countries with the pharmaceutical industry, the increase in the availability of medical care drives changes in the use of medicines. Among them, China is the representative. Especially after the new crown epidemic, more innovative drugs have been launched in China, giving more patients to the market. Under the choice of medication, the expenditure on medication in the Chinese pharmaceutical market will accelerate growth. Among them, the original innovative drugs have the fastest growth rate, with a compound growth rate of 9.4%.

Overview of China's Drug Product Expenditure from 20210 to 2025

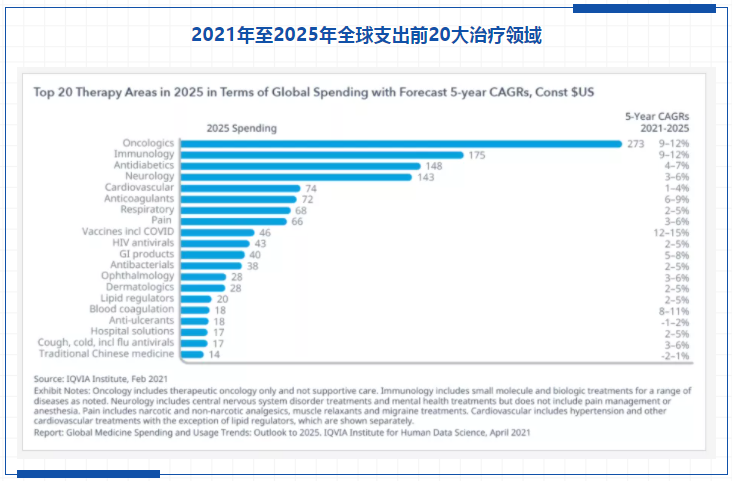

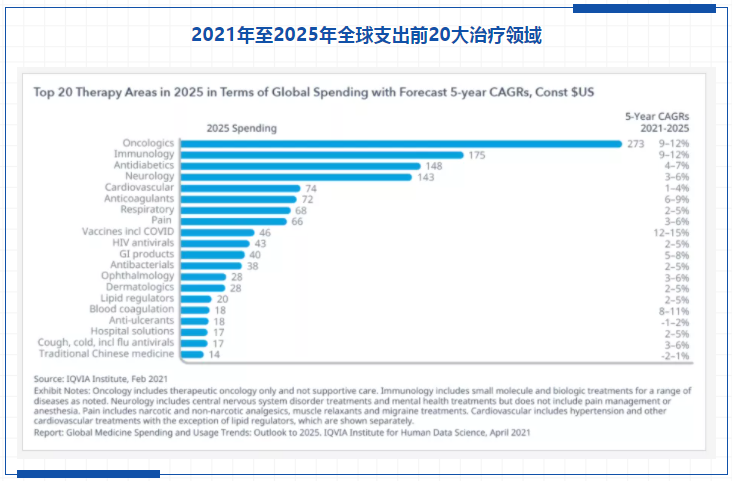

The top 20 treatment areas of global spending are released

The report shows that in the five years ending in 2025, the number of new drugs on the market will grow faster than average. An average of 54 to 63 new drugs are on the market every year, with a total of 290 to 315. In fact, whether it is from the number of innovative drugs for rare diseases approved by the U.S. FDA last year or from the strong policy support of the National Food and Drug Administration for innovative drugs, it can be seen that a large number of innovative drugs will be marketed in a concentrated manner in the future. The review and approval of new drugs will continue to enter the "fast lane". From the therapeutic field, immunology, oncology and neurology are the biggest contributors to the growth in the next five years, mainly due to the continuous emergence of new drugs. It is expected that the compound annual growth rate of oncology and immunology will reach 9-12 by 2025. %; In addition, oncology is expected to add 100 new therapies within five years. By 2025, the expenditure will exceed 100 billion U.S. dollars and the total expenditure will exceed 260 billion U.S. dollars. And neurology is expected to appear more new therapies, including novel migraine therapies, potential therapies for rare neuropathies, and the therapeutic potential of Alzheimer’s and Parkinson’s.

The top 20 treatment areas of global spending are released

The report shows that in the five years ending in 2025, the number of new drugs on the market will grow faster than average. An average of 54 to 63 new drugs are on the market every year, with a total of 290 to 315. In fact, whether it is from the number of innovative drugs for rare diseases approved by the U.S. FDA last year or from the strong policy support of the National Food and Drug Administration for innovative drugs, it can be seen that a large number of innovative drugs will be marketed in a concentrated manner in the future. The review and approval of new drugs will continue to enter the "fast lane". From the therapeutic field, immunology, oncology and neurology are the biggest contributors to the growth in the next five years, mainly due to the continuous emergence of new drugs. It is expected that the compound annual growth rate of oncology and immunology will reach 9-12 by 2025. %; In addition, oncology is expected to add 100 new therapies within five years. By 2025, the expenditure will exceed 100 billion U.S. dollars and the total expenditure will exceed 260 billion U.S. dollars. And neurology is expected to appear more new therapies, including novel migraine therapies, potential therapies for rare neuropathies, and the therapeutic potential of Alzheimer’s and Parkinson’s.

Top 20 treatment areas for global spending from 2021 to 2025

Total global spending on COVID-19 vaccines in 2025 is expected to be US$157 billion

At present, as the new crown epidemic continues to spread, the new crown vaccine expenditure has become one of the largest medical expenditures in the world. According to the IQVIA report, the cumulative total expenditure of the COVID-19 vaccine is expected to be US$157 billion by 2025, mainly concentrated in 2022. The first wave of vaccination completed in 2012. Among them, global spending on COVID-19 vaccines this year is expected to reach approximately US$53 billion. According to previous analysts’ forecasts, Pfizer’s COVID-19 vaccine sales will reach US$14.3 billion this year, followed by Moderna’s US$10.9 billion and Astra Zeneca’s US$6.4 billion. , Novavax’s 3.9 billion U.S. dollars and Johnson’s 3 billion U.S. dollars; the five companies’ new crown vaccine sales will reach approximately 38.5 billion U.S. dollars; however, global COVID-19 vaccine expenditures in 2022 will be 51 billion U.S. dollars, and total expenditures in 2023 will drop sharply to approximately 23 billion U.S. dollars. Murray Aitken, executive director of QVIA, explained in an interview that "Over time, the decrease in expenditure is mainly due to the decline in prices, not the decline in demand. Aitken estimates that the average cost per dose of IQVIA this year is 22 US dollars. In 2022, the price will be 19 dollars. By 2023, the price will drop to about 9 dollars, by 2024 to 7 dollars, and by 2025 to 5 dollars." It is reported that there are currently 11 new coronavirus vaccines in use worldwide, and there may be more changes in the future. Many vaccines have been approved for the market, and the price will drop with the introduction of universal vaccination and the listing of competing products, and the availability of single-dose vaccine options will increase. In particular, the United States recently announced that it has given up its intellectual property patents for the new crown vaccine, and the manufacturing and distribution of vaccines will be further expanded. As a result, the price of the new crown vaccine may become lower and lower.

Total global spending on COVID-19 vaccines in 2025 is expected to be US$157 billion

At present, as the new crown epidemic continues to spread, the new crown vaccine expenditure has become one of the largest medical expenditures in the world. According to the IQVIA report, the cumulative total expenditure of the COVID-19 vaccine is expected to be US$157 billion by 2025, mainly concentrated in 2022. The first wave of vaccination completed in 2012. Among them, global spending on COVID-19 vaccines this year is expected to reach approximately US$53 billion. According to previous analysts’ forecasts, Pfizer’s COVID-19 vaccine sales will reach US$14.3 billion this year, followed by Moderna’s US$10.9 billion and Astra Zeneca’s US$6.4 billion. , Novavax’s 3.9 billion U.S. dollars and Johnson’s 3 billion U.S. dollars; the five companies’ new crown vaccine sales will reach approximately 38.5 billion U.S. dollars; however, global COVID-19 vaccine expenditures in 2022 will be 51 billion U.S. dollars, and total expenditures in 2023 will drop sharply to approximately 23 billion U.S. dollars. Murray Aitken, executive director of QVIA, explained in an interview that "Over time, the decrease in expenditure is mainly due to the decline in prices, not the decline in demand. Aitken estimates that the average cost per dose of IQVIA this year is 22 US dollars. In 2022, the price will be 19 dollars. By 2023, the price will drop to about 9 dollars, by 2024 to 7 dollars, and by 2025 to 5 dollars." It is reported that there are currently 11 new coronavirus vaccines in use worldwide, and there may be more changes in the future. Many vaccines have been approved for the market, and the price will drop with the introduction of universal vaccination and the listing of competing products, and the availability of single-dose vaccine options will increase. In particular, the United States recently announced that it has given up its intellectual property patents for the new crown vaccine, and the manufacturing and distribution of vaccines will be further expanded. As a result, the price of the new crown vaccine may become lower and lower.

references:

1. Global Medicine Spending and Usage Trends: Outlook to 2025

2. Just how much COVID-19 vaccine money is on the table? A whopping $157B through 2025, report says